Reverse Mortgages in Lake Forest, CA

A Trusted Lender For

Reverse Mortgages in Lake Forest, CA.

Reverse Mortgages in Lake Forest

At Green Monarch

We specialize in providing tailored reverse mortgage solutions for homeowners aged 55 and older in Lake Forest, California. Our mission is to help you tap into your home’s equity to enhance your retirement, while relieving you from the burden of monthly mortgage payments.

What is a Reverse Mortgage?

A reverse mortgage enables senior homeowners to transform a portion of their home equity into tax-free cash. Unlike conventional mortgages, there are no monthly payments; the loan is settled when you decide to refinance, sell the home, move out, or pass away.

Benefits of Reverse Mortgages in Lake Forest

- Stay in Your Home:

Keep ownership and stay in your home.

- No Monthly Mortgage Payments:

Experience financial freedom while continuing to pay your property taxes and insurance.

- Multiple Payout Options:

Choose from a lump sum, monthly payments, or a line of credit tailored to your needs.

- FHA-Insured Loans Available:

Partner with a federally approved lender for enhanced security.

Receive Tax-Free Cash

You can receive your funds as a lump sum, giving you the flexibility to use them as you wish!

Obtain a Line of Credit

Create a financial safety net to protect yourself from life’s unforeseen events.

Get Monthly Payments

Get monthly deposits directly into your bank account for bills, expenses, or leisure!

Why Choose Green Monarch in Lake Forest?

With years of experience serving the Lake Forest community, Green Monarch is proud to provide:

- Tailored Services: We adapt our services to meet your unique financial needs.

- Professional Guidance: Our team provides clear, honest guidance to help you make informed decisions.

- Community Knowledge: With deep ties to Lake Forest, we have a comprehensive understanding of the local real estate market.

Reach Out to Us Today

Discover how a reverse mortgage can benefit you. Contact Green Monarch in Lake Forest for a free consultation. complimentary consultation

What is a reverse mortgage?

A reverse mortgage allows homeowners aged 55 and older to convert a portion of their home equity into tax-free cash, all without the need for monthly mortgage payments.

How can I utilize the funds from a reverse mortgage?

The funds can be used for various purposes, including covering daily expenses, paying medical bills, financing home renovations, or enjoying travel experiences.

Will I still own my home with a reverse mortgage in Lake Forest?

Certainly, you retain ownership of your Lake Forest home and can continue living in it as long as you meet the loan requirements.

Confidence • Trust • Security

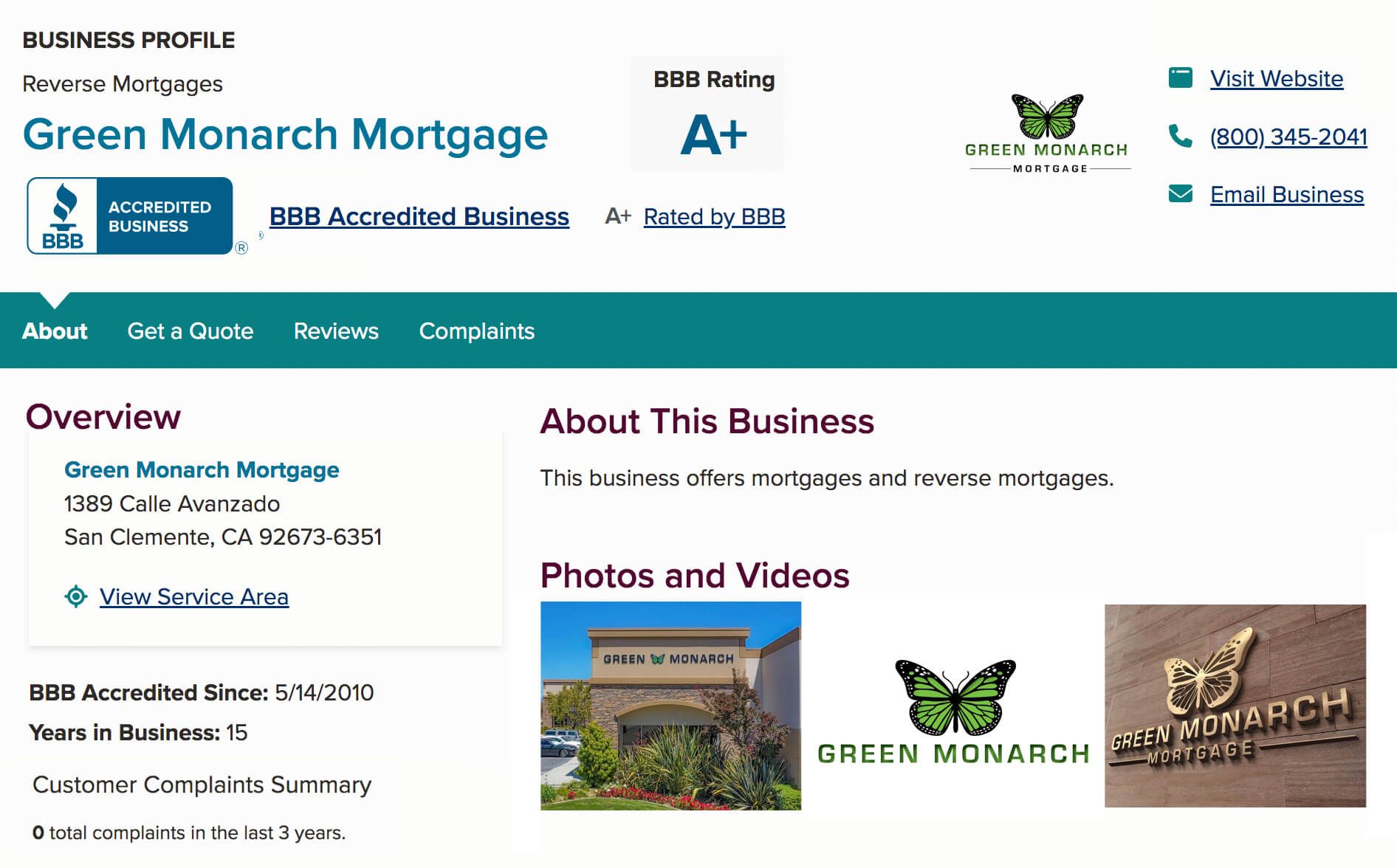

A+ Rated by BBB

BBB Accredited Business

15 Years In Business

0 Complaints